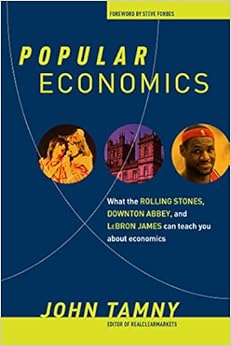

PDF Ebook Popular Economics: What the Rolling Stones, Downton Abbey, and LeBron James Can Teach You about Economics, by John Tamny

Having this publication but never aiming to review is sort of nonsense. You need to review it even few. Reading by few is really better than nothing. You can enjoy reading by beginning in the extremely delightful time. The moment where you could truly filter the information required from this book. The Popular Economics: What The Rolling Stones, Downton Abbey, And LeBron James Can Teach You About Economics, By John Tamny will certainly be so helpful when you really comprehend just what in fact this book supplies. So, locate your on way to see exactly how your choice about the new life within guide.

Popular Economics: What the Rolling Stones, Downton Abbey, and LeBron James Can Teach You about Economics, by John Tamny

PDF Ebook Popular Economics: What the Rolling Stones, Downton Abbey, and LeBron James Can Teach You about Economics, by John Tamny

Now available! Popular Economics: What The Rolling Stones, Downton Abbey, And LeBron James Can Teach You About Economics, By John Tamny as one of the most desired publication worldwide. Guide that is for adults and teens are coming. You could have been waiting for this book for long moments. So, this is the right time to obtain it. Never play with the time anymore, when you have the chance to obtain this publication, why should play with it? When looking the title of this publication here, you will straight visit this page. It will position you making better choice of checking out book.

When obtaining this book Popular Economics: What The Rolling Stones, Downton Abbey, And LeBron James Can Teach You About Economics, By John Tamny as referral to review, you can acquire not simply inspiration however likewise brand-new knowledge and also driving lessons. It has even more compared to typical advantages to take. What type of book that you review it will work for you? So, why need to get this e-book qualified Popular Economics: What The Rolling Stones, Downton Abbey, And LeBron James Can Teach You About Economics, By John Tamny in this write-up? As in web link download, you can obtain guide Popular Economics: What The Rolling Stones, Downton Abbey, And LeBron James Can Teach You About Economics, By John Tamny by on the internet.

A new experience can be gotten by reading a book Popular Economics: What The Rolling Stones, Downton Abbey, And LeBron James Can Teach You About Economics, By John Tamny Also that is this Popular Economics: What The Rolling Stones, Downton Abbey, And LeBron James Can Teach You About Economics, By John Tamny or other book collections. We offer this publication due to the fact that you can find a lot more things to motivate your ability and knowledge that will certainly make you better in your life. It will be likewise beneficial for the people around you. We suggest this soft documents of guide right here. To recognize how you can get this book Popular Economics: What The Rolling Stones, Downton Abbey, And LeBron James Can Teach You About Economics, By John Tamny, read more below.

We share you additionally the way to get this book Popular Economics: What The Rolling Stones, Downton Abbey, And LeBron James Can Teach You About Economics, By John Tamny without going to the book establishment. You can remain to go to the web link that we supply as well as ready to download Popular Economics: What The Rolling Stones, Downton Abbey, And LeBron James Can Teach You About Economics, By John Tamny When many individuals are hectic to look for fro in the book store, you are extremely easy to download the Popular Economics: What The Rolling Stones, Downton Abbey, And LeBron James Can Teach You About Economics, By John Tamny here. So, what else you will opt for? Take the inspiration right here! It is not just providing the appropriate book Popular Economics: What The Rolling Stones, Downton Abbey, And LeBron James Can Teach You About Economics, By John Tamny yet also the ideal book collections. Right here we always offer you the best as well as simplest way.

Review

"Want to understand the vital purpose of stable money in a free-market economy? Read John Tamny's chapters on the importance of reliable standards--whether you are measuring ingredients for a chicken wings recipe, constructing a house, or timing athletes running the forty-yard dash--and you will fully comprehend that money is meant to provide a dependable measure of value. Tamny's writing throughout this brilliant book rings with clarity and consistency; you will be left wondering why these same qualities don't apply to our money."--Judy Shelton, author of Money Meltdown. "Popular Economics is an essential 21st century complement to Henry Hazlitt's Economics In One Lesson. In a book that is happily free of charts and incomprehensible equations, John Tamny uses exciting stories from the world around us to show the reader that nothing is easier than economic growth. Popular Economics is the answer for those confused by the 'dismal science.'"--Arthur Laffer, economist, creator of the "Laffer Curve" "John's book is many things. It's a great way to learn economics, it's a very strong case for economic liberty, and it is an epic myth-buster. I will be giving it out to friends, of all viewpoints, for a long long time."--Cliff Asness, Managing Principal, AQR Capital "Ignore John Tamny's easy to read, Popular Economics, at your own moral peril. It's as close to spiritual as you get in this realm--a better tutorial than any econ text. I'd make it mandatory for the 95% of econ majors--right up through PhDs--who never really got the basics. While making you edgy toward the endless societal consensus nonsense it cuts through like a guillotine--it also frees you to see the true creative beauty of reality all around us."--Ken Fisher, Founder & CEO, Fisher Investments "In a revelatory analysis of the so-called 'financial crisis, ' John Tamny makes the unexpected case that the actual crisis was the huge banking blunder of betting the investment capital of the U.S. economy on housing, a retrospective consumption good already grossly in over supply. Confirming the blunder, government under both Bush and Obama bailed out the banks and debauched the dollar, devaluing the entire entrepreneurial economy of the future. Rare is a book so contrary, so pithy, and so true."--George Gilder, author of Knowledge & Power "John Tamny offers a wide ranging analysis of some of the most pressing issues facing the American economy today, from income inequality and job creation to budget deficits and tax reform. Through engaging examples and stories, he provides a thought-provoking argument in favor of a free market approach to economic growth. Whether you agree with him or not, there is no question that his perspective needs to be part of the discussion on American economy policy in the new millennium."--Enrico Moretti, Professor of Economics, Cal-Berkeley, author of The New Geography of Jobs

Read more

From the Inside Flap

Economics is really pretty basic. In fact, it’s everywhere you look.But a lot of people want you to think economics is terribly complicated. Politicians, bureaucrats, special-interest groups, and economists themselves have managed to turn common sense and simple cause-and-effect into a mystery religion. And they want you, the ordinary taxpayer, to keep a respectful distance.John Tamny is here to break the spell with Popular Economics. You don’t need a Ph.D. and a graphing calculator to understand the economic lessons that are all around us—just the self-confidence to see what’s in front of your nose. Stimulating economic growth is pretty simple, too. It all comes down to Taxes, Regulation, Trade, and Money. Get these four things right, and economic growth would explode. Taxes. Think of taxes as a penalty for working. If Great Britain raises Mick Jagger’s income tax rate high enough, the Rolling Stones are going to find somewhere else to live, and the amount of taxes Great Britain collects from Mick will be zero. Regulation. The smartest people in any industry aren’t the regulators, they’re the people making a living at it. Regulation is based on the fantasy that the mediocre can effectively direct the best and brightest. That’s like expecting the Appalachian State football team to beat Michigan every time they play. Trade. LeBron James could be a pretty good tight end in the NFL, but in basketball he’s the best in the world. So it makes no sense for him to play football. That’s called comparative advantage, and it’s the foundation of free trade. Money. Imagine playing football if the length of a yard changed on every play. Yet that’s how we run our economy. The value of the dollar—the economy’s unit of measure—changes in value every minute.Government tries to convince us that free markets are dangerous. To believe that, we have to ignore reality, and plenty of professional economists are trying to help us do that.But Popular Economics shows that you’re an economist too—and a better one than you think.

Read more

See all Editorial Reviews

Product details

Hardcover: 256 pages

Publisher: Regnery Publishing (April 13, 2015)

Language: English

ISBN-10: 1621573370

ISBN-13: 978-1621573371

Product Dimensions:

6 x 1.1 x 9 inches

Shipping Weight: 1.1 pounds (View shipping rates and policies)

Average Customer Review:

4.4 out of 5 stars

143 customer reviews

Amazon Best Sellers Rank:

#67,583 in Books (See Top 100 in Books)

“Popular Economics†is a well-written, glib primer. In some ways, it’s a dumbed-down version of Henry Hazlitt’s “Economics In One Lesson,†or a severely dumbed-down version of Thomas Sowell’s “Basic Economics.†Its goal is to instruct those with little economics knowledge that John Tamny has all the answers. Actually, it’s to instruct them that John Tamny has one answer to all questions, which is that government is an atrocity, and one solution, which is that the government needs to stop interfering in economic activity.This is true, certainly. Government is an atrocity, at least to the extent it purports to guide our economy. And Tamny delivers his message with clarity and verve. But “Popular Economics†suffers from two defects, one major, one minor. The major defect is common to popular works on economics, left and right—the book is too pat. It presents all its conclusions as both simple and obvious. No possibility of nuance or variation is admitted. No possible counter examples are introduced, discussed and rebutted. In Tamny’s world, as with any ideology, it is All So Very Clear. Ironically, this gives Tamny and his kind much in common with those they despise, the heralds of government action in the economy, such as Paul Krugman, to whom it also All So Very Clear.The second defect is that the book has entirely too many sports analogies. Yes, given that LeBron James is cited in the subtitle, that’s probably to be expected. But nearly every page has a specific sports analogy, and if, like me, you know little about spectator sports and care less, these examples both don’t resonate and tend to be unclear (though the point is usually obtainable). Tamny would have done well not to limit his audience in this way.Aside from these defects, though, the book is, as I say, very well-written and by no means irrational. 80% of what Tamny says is probably true and eminently supportable, although his support is usually limited to cherry picked examples and sports analogies; precise data is singularly lacking.Tamny discusses four major topics: Taxes, Regulation, Trade and Money. In all sections, Tamny has some common threads. First, the “unseenâ€â€”what we don’t have because bad choices, mostly government choices, prevented investment that would have created more for our society. You can’t show the unseen, of course, but Tamny gives classic examples such as Henry Ford to show what can (and he says will) result from private reinvestment of capital not hampered by taxes and regulation. Second, supply creates its own demand—if one does not supply value, one cannot demand anything, and if one does supply value, one does so in order to demand (this is, of course, basically Say’s Law). Third, presumably in response to unstated objections to #2, money will always go to the most productive use, whether saved or spent, EXCEPT if it goes to the government, which by definition only destroys value. What matters is that private enterprise have access to capital, and government seizure reduces that capital, thus necessarily harming society.I am somewhat of an economic ignoramus, so I won’t provide any counter-arguments to Tamny’s claims, though I’m sure it could be done. But I still don’t understand something. Tamny says that “Savers are an economy’s most valuable benefactors,†because they provide capital (through bank deposits and subsequent lending, or direct investment themselves) to producers. But sports stars and movie directors who blow their fortunes on women and coke “stripped themselves of wealth and the economy of the capital to create it.†How are these different? Don’t the women and coke dealers take the money and, ultimately, direct it to the same place that savers do? It’s not like wealth, as measured by money, is being destroyed. (Sure, you can destroy value—see Solyndra. But that’s not what’s happening here.) It seems to me this is a question of the velocity of money, which Tamny doesn’t discuss (and, anyway, it’s pretty clear that he rejects macroeconomics as whole).As to taxes, Tamny lays out why taxes are merely a price placed on work, but also why high taxes on the rich also harm the middling and the poor (because the rich either leave high tax environments, as the Rolling Stones did, throwing all those working below them out of work, or cut back their production). He claims that lower government spending with deficits is better than higher government spending without deficits (i.e., deficits are irrelevant)—the problem is any government spending, which reduces capital available for private use. He wants the rich to hoard wealth, and therefore rejects estate taxes, since that hoarding makes capital available for private use—giving it to charity does not, and therefore harms society overall more than charitable donations would (the unspoken allegation is that charities are largely stupid money pits). And low taxes are good because they increase inequality, and that increases envy, and that increases the incentive to produce. Eduardo Saverin (the Facebook co-founder who reduced his tax bill by renouncing US citizenship) is a hero for keeping money out of the government’s hands and thereby benefiting US citizens. And to the extent we need taxes for core, legitimate government functions, a flat consumption tax is the way to go (unsurprisingly, Tamny loves Steve Forbes, and Forbes wrote the introduction to the book).Tamny then attacks regulation. His basic point is that regulators are stupid and therefore can never hope to successfully regulate the smarter people who went into the productive side of whatever industry they’re in, which is where the regulators would be, if they weren’t stupid—as shown by they’re working for a government wage. “Those with talent generally seek employment with other talented people, where the work is stimulating and the compensation high.†Antitrust laws are similarly pointless, because antitrust regulators (who are stupid, in case the reader forgets) can’t possibly predict the future, as shown by Blockbuster and Betamax. (By antitrust laws Tamny means laws against monopoly—he seems unaware that there are a range of antitrust laws, many of which he might support, such as rules against price fixing).The third section, on trade, is a generic lecture on comparative advantage (as shown by the example of LeBron James playing basketball and not football), “I, Pencil,†and the wonders of globalization. Tamny rejects calls for oil independence, claiming that resources will always be available on the market, and slyly notes that the risk of global warming is overstated, as shown by no diminution in the spiraling prices of waterfront real estate (such as that owned by Al Gore). While all this is true, Tamny is too optimistic about the joys of free trade and human rationality. Israel would do well to be oil independent, whatever Tamny says (and he specifically says Israel should put no effort into energy source acquisition), and Tamny’s claim that free trade prevents war between trading partners is utterly belied by history, including World War I.The final section, on money, is a George Gilder-esque call for the gold standard to be restored, noting that dollar fluctuation makes calculating inflation and deflation impossible. It is also a demand for letting failure delineate the economy—Tamny totally rejects all government action to save failing companies, including all actions taken in the 2008 so-called financial crisis. And Tamny concludes optimistically that after Bush and Obama, people have certainly had it with government, so he predicts a coming boom as government is cut back in 2016 and after. But you certainly can’t accuse Tamny of pessimism.As an introduction to what a certain view of the economy is, this book is excellent. But as an introduction to comparative economic thought, it is worthless. So it all depends on what you’re looking for.

This is the first book on economics that I've read where I actually felt smarter for having read it. Not only was the reading accessible to a non-expert like me--it was enjoyable. The main ideas and the examples used helped me understand more of what I read in the paper and in the news, and I feel like I finally can articulate why some economic policies are good and some not so good. As a bonus, I heard Mr Tamny speak at a special event, and he is as enjoyable in person as his book. A bit controversial, sure, but courteous and intelligent. It made the entire event a real pleasure.

John Tamny is an Austrian Economist, although he probably would not call himself that. He understands that economics is about people - individuals and how they work, save and transact in order to improve their circumstances. He believes in the unhampered economy of individuals acting freely, which brings growth, and creates wealth through innovation. He identifies the capital-destroying activities of government: taxation, spending, regulation, trade restrictions and mistakes with fiat money. He shows how these restrict growth and cause economic crises. If government were denied all these activities, everyone would be better off. He illustrates all these points with simple, real-world examples - hence the pop culture references in the sub-title. This is a good read - and very well based in reputable economic theory.

A spectacularly well-written book. Engaging writing style. Filled with examples of well-know people and events. Exceptionally clear explanations. Systematically explains the fundamentals for understanding what creates a healthy economy. (And what doesn't.) Appropriate for *all* levels, from the novice to the more advanced. Nice bonus: citations from other books which the reader can then pursue. Very highly recommended.

I learned a lot from Mr Tamny. Economics is not just neutral numbers, as some would say, but it is about worldview, like everything else: One's suppositions bring about prospering or faltering financially.

Good ideas aren't dead, just not read! Tamny is the sane voice of economics for our generation, but who is listening? We keep trusting a strongman to fix things, when the answer lies within each of us - to hear truth and act on it. We can vote the taker-enablers out of office. Thanks, John.

Very easy read, lots of insights, great perspective on money. Everyone should read to bthis book. Upsets the apple cart on much of what passes for conventional economic wisdom. I wish all our politicians would read and understand this. I found it to be a real page turner.

One of the very best books that I have ever read. John Tamny puts economics into plain English. Clearly, if you can imagine that in 2000 the cost of an ounce of gold was $266 and today it is $1237 then you must read this book! Millennials, this means you, just read it ASAP!

Popular Economics: What the Rolling Stones, Downton Abbey, and LeBron James Can Teach You about Economics, by John Tamny PDF

Popular Economics: What the Rolling Stones, Downton Abbey, and LeBron James Can Teach You about Economics, by John Tamny EPub

Popular Economics: What the Rolling Stones, Downton Abbey, and LeBron James Can Teach You about Economics, by John Tamny Doc

Popular Economics: What the Rolling Stones, Downton Abbey, and LeBron James Can Teach You about Economics, by John Tamny iBooks

Popular Economics: What the Rolling Stones, Downton Abbey, and LeBron James Can Teach You about Economics, by John Tamny rtf

Popular Economics: What the Rolling Stones, Downton Abbey, and LeBron James Can Teach You about Economics, by John Tamny Mobipocket

Popular Economics: What the Rolling Stones, Downton Abbey, and LeBron James Can Teach You about Economics, by John Tamny Kindle

Posting Komentar